Why Another Product Line Review?

Another product line review? So soon?

If your company’s channel marketing strategy involves big box retailers, like a Lowe’s, Home Depot, or Menards, it seems that there is nearly always a product line review on the dashboard. For many product categories, retail buyers are calling for more frequent reviews and the department merchants are asking more challenging questions of the brands they’re considering.

In our research and creative work for companies that have participated in these annual (or more frequent) “trips to the shark tank,” we’ve seen some changes. In this report, we offer some observations and suggestions for you to consider before your next product line review.

What is a Product Line Review?

A product line review (PLR) is a brand's interview with a retail buyer. Using research, shopper insights, and company background, the PLR is your opportunity to pitch the buyer at a big box retailer about why their customers need your brand, and to gain sufficient shelf space.

How to Prep for a PLR

During the PLR meeting, the retailer typically asks the primary manufacturers in each product category to educate them on the potential market opportunity, as well as their company, products, and go-to-market distribution strategies. Preparing for a product line review with a major retailer can be a demanding process.

In the early planning stages, it’s normally best to follow the outline of topics your buyer has provided in advance of the meeting. Still, if that outline is rather sparse, or you suspect there will be other important issues discussed, it’s good practice to have your bases covered in case the meeting takes off in a different direction.

Overall, be ready to discuss anything that addresses what most buyers are typically seeking – good, solid reasons how your product line will help them maximize their sales, increase their margins, and improve their customers’ satisfaction.

During a PLR, you are being given the opportunity to present your strategy for improving the performance of the category as a whole, not just pitch your product. But anything is fair game if it reaffirms your position as an incumbent brand or helps you state a strong case to gain shelf space if you are the newcomer.

Remember, you are the expert in your product categories, not the retailer. Help the buyer help you by giving open and honest feedback on their current retail assortment and how including your product will benefit them. Include a competitive analysis of product, pricing, promotions, packaging, merchandising, logistics, services, and any other observations that will help them grow their sales, profit, and market share while minimizing space and inventory investment with your product on their shelf.

Deciding Factors

A retailer may call for a product line review from time to time for any reason. Ask questions of the merchant to understand their true interests and help you prepare the most relevant information.

- Are you invited to this PLR primarily to place pressure on the current suppliers to lower prices?

- Is the buyer only interested in a couple of your more unique products?

- Who else has been invited to present and what are your strengths in comparison?

13 New Rules for a Winning PLR

Big box retailers are calling for more frequent product line reviews of many categories and the department merchants are asking new questions that may require additional preparation. Here are some of the new rules for your next PLR.

1. Virtual product line review

Since the pandemic, meetings have more often been conducted virtually as buyers and suppliers see potential savings of time and travel expenses. But while online meeting platforms allow for screen sharing your presentation, they lack certain human interactions you may have taken for granted in face-to-face meetings. If you must hold a virtual meeting, consider digital adaptations, such as 3D animations of your packaging, or a pre-recorded video walk-through of your planogram room.

2. Be flexible with in-person meetings

If your product line review will be an in-person meeting, be aware and respectful of your merchant’s guidelines regarding face coverings and social distancing.

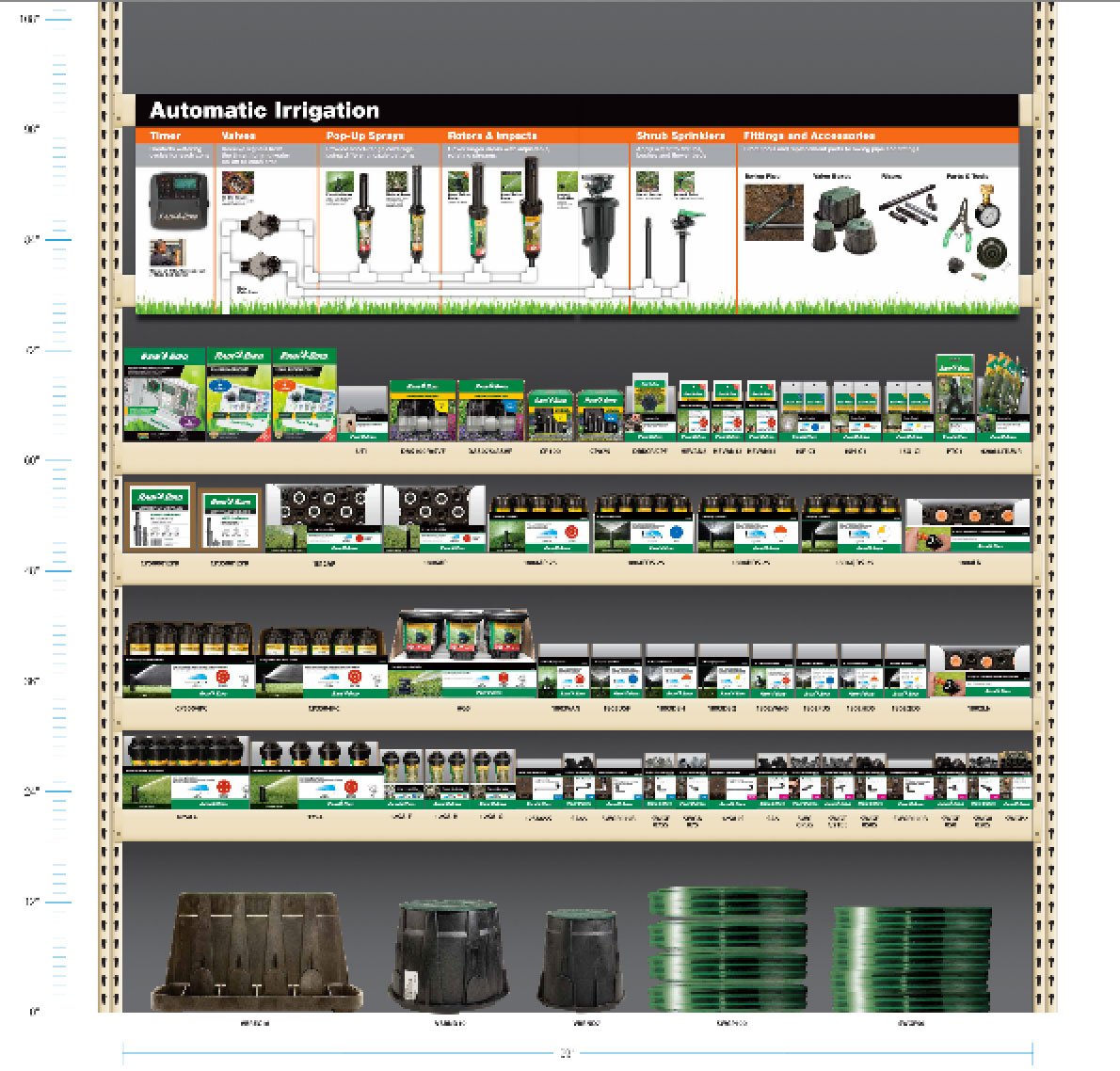

Not all PLRs take place in conference rooms with projectors for displaying PowerPoint presentations. Increasingly, our clients are conducting PLRs in the aisle of a store or in a planogram room. If the presentation is to be at the retailer’s planogram facility, make sure you have reserved space and time in the planogram room and that your products and POP materials will be on hand when you get there for setup. If you need to have the display rack beams set beforehand, be sure to provide the facility coordinators with the shelf spacing needed.

3. Arrange for planogram photos

Because Home Depot, Lowe’s and other retailers do not allow photos to be taken at their facilities, be sure to ask the merchandising team to arrange for photos of anything you need to document. Such photos are valuable after your presentation as you begin the next process of responding to any requested changes and, if all goes well, you move into the implementation phases.

4. Cover your planogram

Bring a drape to cover your planogram when you leave the meeting. Some retailers’ planogram rooms have draping available, but not all do. Draping your presentation is no guarantee that competitors won’t take a peek when they are in the facility, but it will help you maintain a certain amount of confidentiality.

5. You may be asked to send your presentation in advance

Merchants frequently ask for presentation decks in advance of the meeting to give them time to get a feel for what you are proposing, and to allow the PLR to focus on other specific questions. Consider sending an overview presentation and save your thunder for the meeting itself.

6. The agenda isn't always the real agenda

If given the opportunity, ask some probing questions before your meeting to help you understand the retailer’s real motivation for calling the product line review. For example, is the buyer putting pressure on the incumbent to reduce pricing? Is there a plan to introduce private label products? Knowing the answers can help you tailor your presentation to focus on your new or different products, present research that demonstrates the strength of your brand, or make changes to your packaging to influence shopper behavior and benefit the retailer.

7. Pricing is not usually set in the first round

Pricing and margin spreadsheets are among the materials often requested in advance of the PLR meeting. But this information is only a starting point for further discussion. Expect there to be many looks at pricing over the course of the PLR process. How well your proposal fares may be determined by many factors, especially how well your value proposition and brand positioning stand up to scrutiny.

8. Research is critical to validate your brand's value

Category leaders utilize research in their presentations to show how their brand will benefit the retailer and underscore why they deserve shelf space. It’s also useful to identify gaps in the marketplace. We present several ways to do product line review research below.

9. Online traffic and sales history are critical factors

All the online pre-shopping and price checking that takes place before shoppers come into stores provides merchants with valuable insights about your products. The more you enrich your eCommerce content, build traffic, and garner positive review on the retailer’s website, the better off you’ll be at review time. For many of our clients’ PLR presentations, we design demo website pages for use in the meeting, with mockups of landing pages, educational video topics and other online content to suggest improvements that could drive more engagement with shoppers on the retailer’s website.

10. Your packaging is your new POP

Brands are being summarily dismissed on POP signage. Only store brands get top billing in point-of-purchase materials. Signage, if used at all, is intended to lend a sense of continuity to the store departments. It’s all about improving the shopping experience. And even though you may believe your brand deserves to be called out for shoppers, merchants are not “buying it” that brands matter more than basic selection guidance. To counter the lack of exposure, review your packaging to identify your brand consistently and boldly on the shelf. If you have some packages that are larger than others, take advantage of that extra real estate to feature your brand and anchor your planogram.

11. There is pressure to make packaging more consistent across brands

Related to the trend above of de-branding POP signage, there is also a movement to create more consistency in branding. Moving toward an environment where every brand shows product sizes and other selection criteria in a similar way and even with same color coding in some instances, larger retailers and their visual standards committees seem to try to exert their influence to herd everyone into a generic tunnel.

Stand your ground!

Defend your brand!

Communicate with the buyer that your company has strict guidelines related to your logo size and corporate colors. You may find that you’re able to win at least some of those battles.

12. Product innovation matters more than ever

One way to differentiate your brand is to bring new products to the table. Buyers respect new product innovations at line reviews; however, they don’t want to do the heavy lifting to introduce your new product. Here are a few ways to get the most cooperation for a successful product launch:

- Get on the retailer’s promotional schedule. This is easier if you already participate in the retailer's advertising program. And if you are participating, be sure to provide the necessary ad content in proper format and timing.

- Offer limited time exclusivity. This is a tough decision. Assess your company's opportunity with this one retailer vs. other unknown business and make your decision from there. Either way, giving unlimited exclusivity for more than a year should be avoided.

- Work toward special positioning in the stores. Bring renderings of end caps or quarter pallet promotions to your PLR to get the merchant's wheels turning. After all, you both want the same thing: greater sales and margins for your brand.

13. Regional assortments are pivotal to winning your PLR

The retailer expects you to be the expert on your category, including regional differences. A sound strategy for localized or regional assortments will not only help your line enhance its financial performance, it also gives the buyer more informative metrics to report to senior management.

How to Conduct Research for Your PLR

Knowledge is power at a product line review. Whether yours is the category captain defending its turf, or if you are a new challenger wishing to unseat the leader, good research inserts an important reality check into your PLR, answering questions that the retail buyer may not have even considered.

While no two line reviews are alike, it is always good practice to frame any presentation with up-to-date data about your brand and category. Do your homework before your product line review. Your presentation should give retailers reason to support your products.

Start with some essential research to validate your brand and know your company’s position in the market. Here are some thought starters for research to equip you with the ammo you’ll need as you prepare for your product line review.

Know who is buying your products and why

Your merchant may have strong opinions about who their customers are and their behaviors in the aisle. But you need to convince them that you are the expert about your product and who its key buyers are.

Conduct aisle intercept research

This type of study involves placing a field interviewer in the store or outside the store if required. The interviewer approaches shoppers and asks them if they would mind answering a few questions about their shopping experience with your products. It is common to offer a store gift card or other incentive for their participation.

If your merchant is comfortable authorizing intercept research, this type of study can be very effective in revealing insights that will be of definite interest in a PLR meeting. You might ask shoppers about what brought them to the department, what project they are working on, why they did or didn't buy, if it is a first-time purchase or for replacement, if the merchandising answered their questions; the list is endless. Of course, the study's scope should be kept fairly simple. You can't expect shoppers to speak to researchers for very long. Still, the idea of engaging with customers at the time they are considering your products is very compelling.

Some points to keep in mind:

- Choose a research firm that has experience in this type of study. The firm should have established connections with good field interviewers in the cities involved.

- Allow enough time for the study so that sample size is adequate. Unless your products are frequently purchased, you might be disappointed in how few transactions there are on a given day. And of those making a purchase or visiting the department, figure that only a percentage will consent to an interview.

- Ask the field interviewers to take photos of the display assortment and signs. Even though you may have a set planogram, there may be differences in how it is implemented in each store, possibly explaining some of the findings.

- Consider regional differences if important for your category. For example, you might arrange for the study to be done in a few stores in each of 4-5 regions.

Research keywords being used to search your products and your company.

There are many online tools available to determine the words and phrases commonly searched. The Google Ads platform provides insights on keywords as well as the demographics of those searching. Also from Google is the Google Search Console which, together with Google Analytics, provides information about visitors to each page of your website. All of this anecdotal information is useful when presenting market profile information related to your category. Other resources: aHrefs Keywords Explorer, SEMrush.

Review your warranty registration data

If your customers must register for warranties, there may be a gold mine of information there about customer profiles and how they may have changed over time. An online registration form can encourage more registrations as well as more information about customers. Ask where they heard about your products, where they purchased, as well as their age, income, geographic location and other data.

Summary of online reviews and social conversation related to your category

Presenting any information about consumer use, ranking and social conversations about your products can be a great conversation starter in a PLR meeting. Don't assume that the merchant is studying the reviews as thoroughly as you may be doing. Offer your take on the tone of the comments, both those that are positive as well as negative. Also mention how your company has responded to any negative comments.

For social tracking of what consumers are saying about your brand, some useful sources are: Sprout Social, SEMrush Brand Monitoring.

A/B test your ads

Talking about the ad support you provide for your brand is one way to demonstrate category leadership. You can add further creds for the sophistication of your marketing program by discussing any ad testing you have done to reveal information about who is buying your products and why. An A/B ad test is ideal in that it can shed light on ad message strategies that resonate best, ultimately providing input to a whole spectrum of related activities, including online content, package and POP messaging.

A/B testing basically involves splitting the media plan in half, running two different ads or campaigns in each half and measuring results. Doing this with digital ad tracking codes and landing pages will make this easiest. Tracking of print ads or other traditional media testing is also possible by placing QR codes, promo codes or even different telephone numbers in the ads and comparing inbound activity generated.

Perform an advertising study

Leading brands tend to spend more on advertising and marketing, and that additional brand awareness also benefits the retailer. Document how your brand, as well as your own competitors, are spending on ads to attract customers in the category. If your brand is investing in the hunt, demonstrate to the buyer what you’d be willing to invest to help drive customer interest.

Develop profiles of each major competitor in your category, their advertising content and spending level. Even if you are not the largest spender, build a case for how your marketing is outsmarting the competition with other tactics, such as social media, SEO, and Inbound Marketing.

Assemble examples of your past and current ad campaigns. Show off your best ads and explain the results you achieved. The success of your brand’s awareness also benefits the retailer.

Conduct a brand recognition survey

In an effort to drive your pricing down, be ready if the buyer attempts to devalue your brand. You can counter this tactic and validate the power of your brand by showing evidence that your brand matters to shoppers. But you’ll need to do some homework in advance with a brand recognition survey.

4 ways to conduct a brand recognition survey

- Participate in a syndicated brand tracking study such as the Harris Poll EquiTrend Study.

- Conduct a custom survey with an independent panel specific to your brand. (The Harris Poll also provides custom survey solutions).

- Quote existing surveys that have been conducted about your products in other channels. For example, note how a strong position with professional users may influence credibility among DIYers. One source for available research is ResearchGate.

- Develop your own independent survey using a research platform such as SurveyMonkey. Because you typically use your own database of prospects and customers, the results are more open to bias, and yet, it can still be useful as an ongoing benchmark.

A brand recognition survey underscores your brand’s relevance and demonstrates how it will positively influence category growth and margins for the retailer.

Conducting your brand recognition survey every year will show changes to key indices over time and can help you identify areas for improvement.

Velocity and margin analysis

Demonstrate your willingness to partner with the retailer by doing a thorough analysis of the performance of your product line. Note any weak areas as well as your strengths and suggest adjustments that would be good for the retailer.

If your business involves The Home Depot, their Askuity analytics platform provides robust sales data at store level, enabling you to keep tabs on activity by item, by region and a whole host of other measurements you can discuss.

Analyze any available metrics including:

- Rank products by units, volume, margin, average inventory turnover, sales per sq ft and fill rates, showing at least 3 years of trend data.

- Compare your products against competitive offerings if the retailer will share the information.

- Identify any products that you feel should be eliminated or repackaged.

- Suggest planogram changes such as placing go-together items near each other on the shelf.

Packaging and preference study

Is your packaging and POP messaging the best it can be for this channel? If you have more than one option for a packaging change, new product, planogram refresh or other variables, choose one to present in your line review. Test your variations in advance using a preference study, a test store program (more below), or some other selection method. Consider these methods:

- Online survey with high resolution images of your products and packages.

- In-depth, one-on-one interviews (in person or via video conference).

- Live group panel (in person or via video conference).

- Conventional focus groups.

The research method you choose may depend in part on the level of confidentiality required.

Be sure to use actual products and packaging, or high-quality prototypes and images to ensure that you obtain realistic feedback.

Test store program

Perhaps the most telling method to pre-test different branding concepts is to test them in an actual retail environment. In-store testing requires close coordination with the retailer, of course. But that can be a big advantage, as it can lend a sense of co-authorship.

To get started with in-store testing:

- Select store locations and the variables to be tested. For example, typical plan would to be have 8-10 stores minimum, located in varying demographic areas, with metrics collected per the merchant's interests. For example, you may wish to track item purchases by day, margin dollars generated for the category overall before vs. during the study period, average size of purchases, returns or other data that is key to winning more stores.

- Arrange for logistics of in-store setup and maintenance. You’ll want to control factors such as restocking to ensure consistent data. Most retailers have established partnerships with setup companies they will allow in the stores. Restocking is most often handled by store personnel. But it is always a good idea to ask the store service company to double-check your assortment on a regular basis, especially during a test.

- Decide what metrics to track such as unit sales and average purchase size. Have a provision for capturing sales data from a physical audit the retailer's POS system if possible.

- Conduct personal interviews with store associates that work the department. You can learn a lot by talking with them. Example question: What is most confusing to shoppers about the product or category?

Web traffic analytics

“Brick and mortar” stores are concerned about being upstaged by Amazon and other online retailers. Your own company’s website is a gold mine of data that can reveal insights on what visitors were searching before coming to your site, what pages they hit, and more. Use this information as talking points to describe online interest in your brand and products.

Here are some points from your website’s Google Analytics to summarize in your line review presentation:

- Pages with the most traffic.

- Demographics and interests of site visitors.

- Search terms being used to find your site.

- Referring sites to reveal where visitors are coming from repeat vs. new visitors.

- Numbers of visitors prompted by the website to follow your social media channels.

PLR Presentation Outline

The following outline can be a starting point for your presentation. As mentioned earlier in this article, make sure you cover any required topics that may have been provided by the merchant. If any of the below-listed points such as "Brand and Company History" have been covered in past meetings with this merchant, it still may be a good idea to have them in your deck for any potential sharing with others in the retailer organization. If one or more subjects are a repeat, you just may not choose to say so much about those particular points during the meeting.

- Brand and company history. Include profiles of your company’s leadership and commitment to consumer DIY products.

- Total market size (by channel, if available).

- Your share of market (Include your view of competitors’ positions if this information enhances your story).

- Major trends or current news impacting the category (SWOT analysis).

- Your ability to service and grow the business for the retailer. If you are the incumbent, be ready to present information about your line fill rates and on-time stats.

- Suggested assortments and pricing by region.

- New products, innovations. Include any opportunities for exclusivity to the retailer.

- Your product’s strengths/weaknesses vs. your competition. Be specific with side-by-side comparisons.

- Suggested planogram and POP materials including renderings, set-up instructions, and proposed messaging with rationale.

- Promotions (stackouts, end caps, special offers).

- Advertising plans (including traditional, digital, and social media).

- How-to videos, and other use of video to extend product exposure.

- Planning for product knowledge (PK) training and other support for store employees.

- Online content enhancements for the retailer’s website.

- Strategy for monitoring your line’s performance with the retailer.

How We Can Help

Winning and maintaining a strong position with retailers can be an unrelenting challenge. Preparing for a product line review with a major retailer can be a demanding process that involves research, quality merchandising, and package design, not to mention a touch of sales finesse. Use the tips and resources we’ve presented to show the retailer how your product on their shelves will enhance the category and improve their bottom line.

For nearly 30 years, Heinzeroth Marketing Group has helped clients win dozens of line reviews. Working in partnership with leading brands in consumer DIY categories including irrigation, plumbing, paint, electrical, tools, cabinet, hardware, crafts, building materials and outdoor living categories, we can help you prepare for your upcoming PLR with better presentations and channel marketing initiatives designed to win and grow more business at The Home Depot, Lowe’s, Menards and other major retailers.

Our team can help you with research and creative support to keep your products on the shelf and performing well in the channel.

- In-house planogram room

- Photo studio and video production

- Graphic design

- Flex space to assemble mockups for special projects